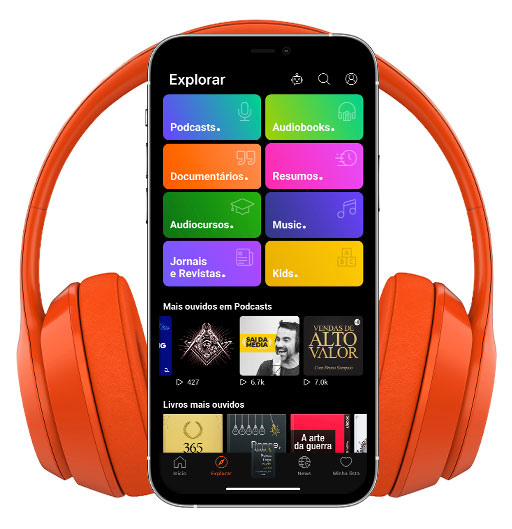

Sinopsis

Exploring the ideas, methods, and stories of people that will help you better invest your time and money. Learn more and stay-up-to-date at InvestorFieldGuide.com

Episodios

-

[REPLAY] Albert Wenger - World After Capital - [Invest Like the Best, EP.80]

17/09/2019 Duración: 01h08minMy guest this week is Albert Wenger, a managing partner at Union Square Ventures and the author of the book World After Capital. Albert studied economics at Harvard and earned a PhD in information from technology, but if you’d asked me to guess before looking those up, I’d have guessed that he studied philosophy because of how widely he has thought about the world and the impact of technology. Our conversation is about how technology is changing the world from an Industrial Age to a knowledge age. We explore how cryptocurrencies, low cost computing, and regulation will impact our future and why the transition may require delicate care. I loved this conversation because of my obsession with the concept of scarcity. We explore what has been scarce through time and what may be scarce in the future. Albert is one of the most interesting thinkers I’ve come across and was a pleasure to speak with. I hope you enjoy our conversation. Hash Power is presented by Fidelity Investments For more episodes go to Investo

-

[REPLAY] Deep Basin – Earning Alpha in Energy - [Invest Like the Best, EP.81]

11/09/2019 Duración: 56minMy guest this week are Matt Smith and Ian singer of Deep Basin Capital, a hedge fund specializing in the energy sector. I first met Matt almost 10 years and, in that time, I’ve grown to respect him as much as any investor that I’ve ever met. Now having spent time with Ian, who specializes in oil and gas field exploration companies and the rest of the Deep Basin team, I have similar respect and admiration for all of them. Deep Basin does almost the exact opposite of what us quants do. In fact, their entire goal is to build a portfolio of mostly idiosyncratic or stock specific risk, the very thing us quants mostly remove from portfolios. Deep Basin positions the portfolio to make a series of carefully constructed bets, long and short, without taking market risk, style-factor risk, or even commodity risk. They use a hybrid fundamental and quantitative process which we explore in detail. This is definitely another good example of who we are all up against in public markets. What makes this story unique is tha

-

[REPLAY] Pat Dorsey - Buying Companies With Economic Moats - [Invest Like the Best, EP.51]

27/08/2019 Duración: 51minMy guest this week is Pat Dorsey, who was the longtime director of equity research at Morningstar, where he specialized in economic moats: sources of sustained competitive advantage that allow a few companies to deliver huge returns over time. Several years ago he left Morningstar to form his own asset management firm, Dorsey asset management, and build a portfolio of companies with wide moats like those he studied at Morningstar. And while moats are critical, equally important is how companies allocate the capital generated--or made possible--by the existence of the moat. A special thank you to Brian Bares who introduced me to Pat, and to Will Thorndike--an earlier guest on the show. In the vast majority of conversations you hear on this show, I'm meeting the guest for the first time. I mention this to encourage you to connect me with anyone whose story or way of looking at the world might resonate. Always feel free to contact me with ideas. Pat and I begin our discussion with the key differences betwe

-

Joe McLean – How to be a Pro’s Pro - [Invest Like the Best, EP.143]

20/08/2019 Duración: 53minMy guest this week is Joe McLean, the founder of Intersect Capital, which provides financial advisory services to a variety of clients, including a number of NBA players and other professional athletes. What I loved about this conversation was the weaving of sport, coaching, and finance into a cohesive whole. There’s so much to take from this discussion—from the importance of service and low self-orientation to the impact of strict standards for who you work with, to common mistakes we all tend to make with money. Please enjoy my conversation with Joe McLean. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:18 - (First Question) – His backstory and the combination of athleticism and finance 2:43 – His time in Ireland 3:29 – Moving away from basketball and into finance 6:08 – What the Inte

-

Zack Kanter – All Things Business - [Invest Like the Best, EP.142]

13/08/2019 Duración: 01h23minThis week’s guest is, Zack Kanter, the founder and CEO of the Stedi. Zack and I decided not to talk much about his business on this podcast and opted instead to explore more generally, so a bit of an introduction to what they do may be helpful here for some extra context. Stedi is a platform for exchanging and automating 300+ types of business-to-business transactions - transactions like purchase orders, invoices, etc. It’s a modern take on an archaic protocol called EDI - electronic data interchange, something I’d never even heard of until several months ago. Learning about EDI is a bit like finding out about the Matrix - every physical object you come across, from the food you ate for breakfast to the clothes you’re wearing and consumer electronics you use - anything with a barcode on it - was likely touched by EDI, often dozens of times before making it into your hands. Stedi is the first update to this messaging later in decades. Our conversation in this podcast is about business in general, starting wi

-

Chris Bloomstran – What Makes a Quality Company - [Invest Like the Best, EP.141]

06/08/2019 Duración: 01h18minMy guest this week is Chris Bloomstran, the president and chief investment officer of Semper Augustus Investments Group. He became famous in investing circles a few years back for his incredibly detailed investigations of Berkshire Hathaway. While we do cover Berkshire towards the end of the conversation, we spend most of our time talking about what makes for a quality business. I loved some of his angles on the current landscape, including our discussion of companies like Richemont and Disney which are actively taking distribution back in house. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:18 - (First Question) – Largest investing error 4:52 – Defining quality investor and their investment strategy 11:48 – Incremental return on capital and other themes that th

-

Brian Christian – How to Live with Computers - [Invest Like the Best, EP.140]

30/07/2019 Duración: 01h01minMy guest this week is Brian Christian, the author of two of my favorite recent books: Algorithms to Live By and The Most Human Human. Our conversation covers the present and future of how humans interact with and use computers. Brian’s thoughts on the nature of intelligence and what it means to be human continue to make me think about what works, and life, will be like in the future. I hope you enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:11 - (First Question) – Summarizing his collection of interests that led to his three books 2:59 – Biggest questions in AI 3:43 – Defining AGI (Artificial General Intelligence) and its history 5:18 – Computing Machinery and Intelligence 7:54 – The idea of the most human human 9:59 – Tactics that have changed the mos

-

Eric Sorensen - How Quant Evolves - [Invest Like the Best, EP.139]

23/07/2019 Duración: 58minMy guest this week is Eric Sorensen, the CEO of Panagora asset management, which manages more than $46B for clients across a variety of strategies. Eric began his career serving in the Air Force as both a pilot and instructor in high-performance jet aircraft. He then accumulated 40 years of quantitative research and investment experience, with a Ph.D. along the way. Please enjoy our conversation on the changing landscape of quantitative investment strategies. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:15 - (First Question) – His background in the Air Force 1:23 – Boyd: The Fighter Pilot Who Changed the Art of War 3:18 – Training people on high-performance machines 4:47 – Traits that made for better pilots 5:51 – The evolution of quantitative equity research and its stages

-

Jane McGonigal – How Games Make Life Better - [Invest Like the Best, EP.138]

16/07/2019 Duración: 01h11minJane McGonigal, PhD is a world-renowned designer of alternate reality games — or, games that are designed to improve real lives and solve real problems. She is the Author of Reality is Broken: Why Games Make Us Better and How They Can Change the World and is the inventor and co-founder of SuperBetter, a game that has helped nearly a million players tackle real-life health challenges such as depression, anxiety, chronic pain, and traumatic brain injury. Our conversation is about how to design useful games, how games effect us and our kids, and what the future might hold. Please enjoy. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:22 - (First Question) – Her take on the history of gaming and studying the players themselves 3:44 – Where her passion for gaming really started 4:55 – Her take on

-

Bill Gurley – All Things Business and Investing - [Invest Like the Best, EP.137]

02/07/2019 Duración: 01h09minMy guest this week is Bill Gurley, a general partner at Benchmark Capital and one my favorite investment thinkers. As you’ll hear, despite enormous success through his career, Bill is clearly still in love with business and investing. Where many might discuss past glories, I’ve been incredibly impressed with how both Bill and his partners emphasize the current portfolio and market landscape. I’m thankful to have had the chance to speak with him in this format. I hope you enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:13 - (First Question) – The idea of increasing returns 1:21 – Competiting Technologies, Increasing Returns, and Lock-in By Historical Events 2:07 – Complex Systems Theory – Santa Fe Institute 4:35 – Markers that could be a sign of

-

Jesse Livermore – The Search for the Truth with the Anonymous Master - [Invest Like the Best, EP.136]

25/06/2019 Duración: 01h39minThis week I have a very special guest years in the making. Like another favorite episode, with anonymous guest Modest Proposal, this conversation is with one of the stars of the financial twitter universe who writes anonymously and goes by the pseudonym Jesse Livermore. I met Jesse 6 years ago after reading his unbelievably unique investing research, which tackled all the big and interesting issues in markets. He now also works with me as a research partner at OSAM, where’s he’s used our data to continue to his search for truth in markets. Despite being one of the brightest minds I’ve encountered he is also as humble and unassuming as they come. I’m at least a slightly better person because of trying to emulate how he conducts himself. I get to have many conversations with him that go from 0-100 fast, and I’m thrilled to be able to share one of those with you. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestio

-

Chuck Akre – The Three-Legged Stool - [Invest Like the Best, EP.135]

18/06/2019 Duración: 49minMy guest today is Chuck Akre, a now widely famous investor who founded Akre Capital Management in 1989, which now manages approximately $10B dollars. We discuss his investing style and his “three-legged stool” for evaluating companies. Please enjoy this great conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:06 - (First Question) – Advantage of being in Middleburg, Virginia 2:11 – What a day looks like for Chuck 3:06 – Why imagination is more important than knowledge 3:38 – Difference between curiosity and imagination 4:38 – The origins of the Nirvana Three-Legged Stool concept 10:14 – First leg of the stool, Extraordinary business and ROE’s with a focus on Bandag. 14:36 – How his evaluations of value has changed over the last 10-15 years 16:10 – A look at recent businesses that

-

Jerry Neumann – Why Venture is Hard - [Invest Like the Best, EP.134]

11/06/2019 Duración: 01h01minMy guest this week is Jerry Neumann. Jerry is one of the most thoughtful early stage investors that I’ve encountered, and his writings at reactionwheel.net are my favorite on this topic. He applies an incredibly structured way of thinking to a notoriously mysterious investment category. This is our second conversation, in which we cover why investing with one’s gut is a bad idea and why some of the popular edges in startups, like network effects, may be picked over. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:17 - (First Question) – His take on the venture landscape and the type of investments new VC’s are making vs what they should be making 3:44 – Most important implications of excess VC firms 5:32 – Misalignment of incentives in the VC space 8:19 – What he

-

[REPLAY] Sam Hinkie – Data, Decisions, and Basketball - [Invest Like the Best, EP.88]

04/06/2019 Duración: 01h07minI came across this week’s guest thanks to the overlap of three passions of mine: data informed investing, value creation, and basketball. Sam Hinkie worked for more than a decade in the NBA with the Houston Rockets, and then most recently as the President and GM of the Philadelphia 76ers. He helped launch basketball's analytics movement when he joined the Houston Rockets in 2005, and is known for unique trade structuring and a keen focus on acquiring undervalued players. Today, he is also an investor and advisor to a limited number of young companies in which he feels his experience can improve outcomes. Please enjoy this unique episode with Sam Hinkie. Show Notes 3:24 – (First Question) Advantages of having a long view and how to structurally harness one 6:08 – Using technology to foster an innovative culture 6:18– Empire of the Summer Moon: Quanah Parker and the Rise and Fall of the Comanches, the Most Powerful Indian Tribe in American History 10:16 – Favorite example of applied innovation fr

-

David Epstein – Wide or Deep? - [Invest Like the Best, EP.133]

28/05/2019 Duración: 01h24minMy guest this week is David Epstein. David is a writer and researcher extraordinaire and the author of two great books. His second, Range, is out today and I highly recommend it. We discuss the pros and cons of both the generalist and specialist mindsets in detail and go down many interesting trails along the way. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:12 - (First Question) – What he uncovered in “The Sports Gene: Inside the Science of Extraordinary Athletic Performance” that led him to his latest book 2:38 – Debate with Malcolm Gladwell (YouTube) 4:12 – What did the public pay most attention to and what did they gloss over 7:56 – How his views on nature vs nurture shifted during the process of writing The Sports Gene 10:05 – Blending prac

-

Priya Parker – The Art of Gathering - [Invest Like the Best, EP.132]

21/05/2019 Duración: 57minThis week I’m hosting an investor retreat and so thought it fitting to release this conversation with Priya Parker on the art of gathering. I’ve been interested in the topic of community and gathering for some time and along with the book The Art of Community, Priya’s book on the art of gathering is by far the best I’ve read. It is both conceptually interesting and extremely practical. In the book there is literally a table for how big a gathering space should be per person, sorted by the type of vibe you are after. We had a time constraint but I could have talked to Priya for much longer. I hope you enjoy our conversation as much as I did, and that it inspires you to do something new and different with friends, family, or colleagues. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:23 - (First

-

[REPLAY] Tim Urban - Grand Theft Life - [Invest Like the Best, EP.59]

14/05/2019 Duración: 01h22minThis week’s conversation is about artificial intelligence and interplanetary travel. Its about content creation, thinking from first principles, and death progress units. Its about brain machine interfaces and why it is crucial that you be a chef and not a cook. My guest is Tim Urban, along with his business partner Andrew Finn. Tim is the most entertaining writer I’ve come across in years, who explains complicated and interesting topics to his millions of dedicated readers on the website “Wait, But Why.” As an example, Tim’s last post on Elon Musk’s neurlink venture is 40,000 words long, roughly the length of a short book. It explains almost all of human progress and our potential future using drawings and cartoons. Its impossible to stop reading. While this conversation is wildly entertaining, it is also chock full of metaphors and lessons that will be useful to anyone doing creative work or building a company. I hope this leaves you as energized as it left me. I called this episode Grand Theft Life beca

-

Stephanie Cohen – The Evolution of M&A and Corporate Strategy - [Invest Like the Best, EP.131]

07/05/2019 Duración: 57minMy guest this week is Stephanie Cohen, who is the chief strategy officer for Goldman Sachs and a member of their management committee. Prior to her current role, she spent the majority of her career in the investment banking and M&A divisions at Goldman. We discuss lessons learned from her career in M&A and the many initiatives she now leads at the firm. I really enjoyed her perspective on how a big, established firm like Goldman can balance innovation with improving existing businesses. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:15 - (First Question) – Motives on both sides for doing M&A 3:26 – Most difficult deal she worked on 4:50 – Biggest value add she brought from her seat on the Fiat deal 5:59 – Biggest changes since she started to today 8:31 – Sm

-

[REPLAY] Will Thorndike - How Skilled Capital Allocators Compound Capital - [Invest Like the Best, EP.36]

30/04/2019 Duración: 01h10minThis week’s guest is Will Thorndike, an author and investor whose book The Outsiders is an all-time favorite of mine. Our conversation is in two parts. First, we dive deep into the lessons of his 8-year research project studying CEOs who were master capital allocators. These CEOs include Henry Singleton, John Malone, Tom Murphy, Katherine Graham, and Warren Buffett. We discuss how these CEOs tended to be contrarians on topics like dividends, buybacks, acquisitions, and the use of debt. As we go through each of the tools in the capital allocators toolkit, you’ll hear several useful lessons for running or evaluating a business. In the second part, we cover Will’s career in private equity. Will founded and continues to run Housatonic Partners, investing in buyouts, recaps, and search funds. Will has been one of the most active search fund investors for decades, and given how much time I’ve spent in past episodes on the searchers or operators in the micro-cap, permanent equity space, it was great to get the pers

-

Josh Wolfe – The Tech Imperative - [Invest Like the Best, EP.130]

23/04/2019 Duración: 01h04minMy guest this week is Josh Wolfe, co-founder and managing partner at Lux Capital. I had Josh on the podcast last year which was one of the most popular episodes in the shows history. This is a continuation of our ongoing conversation about investing in the frontiers of technology. My favorite thing about Josh and the way that he invests is the mosaic that he and his team at Lux are constantly building to understand the world and where new companies may fit in. We cover a crazy variety of topics from business model innovation, roles of a CEO, the military, the death of privacy, and arrows of human progress. Please enjoy round two with Josh Wolfe. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:22 - (First Question) –Ability to tackle massive scale problems 4:05 – Key roles of leaders and his checkli

![[REPLAY] Albert Wenger - World After Capital - [Invest Like the Best, EP.80]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/4B48FA74-C562-954B-C7EB-761040ED6E86.jpg)

![[REPLAY] Deep Basin – Earning Alpha in Energy - [Invest Like the Best, EP.81]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/ECC435D6-0429-37DA-5B7A-6EB20A9CAC6C.jpg)

![[REPLAY] Pat Dorsey - Buying Companies With Economic Moats - [Invest Like the Best, EP.51]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/27AB7265-D004-067D-2DDD-30B5F72E5AFE.jpg)

![Joe McLean – How to be a Pro’s Pro - [Invest Like the Best, EP.143]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/268BCBCB-071A-8C9E-C947-D1EF4136E7F3.jpg)

![Zack Kanter – All Things Business - [Invest Like the Best, EP.142]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/9AB37B5E-CD97-EE57-FB3D-BD40159EA659.jpg)

![Chris Bloomstran – What Makes a Quality Company - [Invest Like the Best, EP.141]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/4D9132C8-C02E-770B-2418-CFEDF2BA43F8.jpg)

![Brian Christian – How to Live with Computers - [Invest Like the Best, EP.140]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/B5982D69-89A4-FDDF-1FFB-7B2666414C1B.jpg)

![Eric Sorensen - How Quant Evolves - [Invest Like the Best, EP.139]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/0FFBFA4F-B587-DD99-A8E9-FAAC386114B6.jpg)

![Jane McGonigal – How Games Make Life Better - [Invest Like the Best, EP.138]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/DA6B3B51-932D-7579-8AED-54780253EABA.jpg)

![Bill Gurley – All Things Business and Investing - [Invest Like the Best, EP.137]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/D89F8F1E-FCDE-5EBD-316E-0488E094003B.jpg)

![Jesse Livermore – The Search for the Truth with the Anonymous Master - [Invest Like the Best, EP.136]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/900FE589-062E-6E3C-1D22-BE535BD4CFB8.jpg)

![Chuck Akre – The Three-Legged Stool - [Invest Like the Best, EP.135]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/09ADA403-6369-B458-4479-2F8595DCD371.jpg)

![Jerry Neumann – Why Venture is Hard - [Invest Like the Best, EP.134]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/B8D82E7B-A06D-5F6D-D3E8-A8B8D712DA05.jpg)

![[REPLAY] Sam Hinkie – Data, Decisions, and Basketball - [Invest Like the Best, EP.88]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/46D5DCB6-729B-EC5D-79D3-7D7D84A3683C.jpg)

![David Epstein – Wide or Deep? - [Invest Like the Best, EP.133]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/8FEC46E1-7466-3710-8049-50D222625AEA.jpg)

![Priya Parker – The Art of Gathering - [Invest Like the Best, EP.132]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/2154525C-E57D-4D6E-02AA-5424FD419C00.jpg)

![[REPLAY] Tim Urban - Grand Theft Life - [Invest Like the Best, EP.59]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/F00C4D56-FA09-86C9-CD68-0E4064989F90.jpg)

![Stephanie Cohen – The Evolution of MA and Corporate Strategy - [Invest Like the Best, EP.131]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/AB33DED7-FF16-383E-246A-022961BB279C.jpg)

![[REPLAY] Will Thorndike - How Skilled Capital Allocators Compound Capital - [Invest Like the Best, EP.36]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/DC0CE739-49E0-4B7D-AAAF-B3D22BF94B9B.jpg)

![Josh Wolfe – The Tech Imperative - [Invest Like the Best, EP.130]](http://media3.ubook.com/catalog/book-cover-image/319993/200x200/72333AFA-9A83-2C1F-8CDC-5BEAA278D65E.jpg)